ALL INDIA BANK EMPLOYEES' ASSOCIATION

Central Office: Chennai-600001

CIRCULAR NO. 28/250/2020/88

12-11-2020

TO ALL UNITS AND MEMBERS:

Dear Comrades,

• 11th Bipartite Settlement signed

• Platinum Jubilee Gift from AIBEA to bank

employees

• Greetings and massive congratulations

• You have created one more milestone in our

onward march

• One Nation One Salary achieved.

*Tribunalisation to Bipartism:*

Ever since AIBEA was founded on 20th April,

1946, endeavouring to improve the wages

and service conditions of bank employees has

been a part of our basic commitment. From

those days of jungle rule exploitation by the

management, we travelled to the days of

pleading before Tribunals and were faced with

unsatisfactory Awards.

Then dawned the era of bilateralism from 1966 when AIBEA fought a royal battle and achieved the first ever bipartite settlement in any industry at that time. Bipartite Settlement in Banks became a hallmark for others to follow and thus AIBEA became the pioneer and pace-setter. It became a trend and AIBEA achieved 10 bipartite settlements thereafter in 1970, 1979, 1984, 1989, 1995, 2000, 2005, 2010 and 2015. This is the 11th successive one the 11th Bipartite Settlement which AIBEA has signed yesterday. AIBEA is the only organisation that has signed all the 11 Bipartite Settlement so far. We can

legitimately feel proud about it. It is a unique achievement indeed.

*Attacks on bipartism:*

It is important to remember that in the last five decades, there have been innumerable attempts to scuttle this bilateral system to foist third party interventions. We have constantly opposed these attempts. This time also, there were

serious attempts by anti-AIBEA inimical forces

to foist a Tribunal. We are happy that we could overcome all these nefarious moves and

sign one more bipartite settlement thus preserving the hard-won right of collective bargaining and bilateralism which have been bequeathed to us by our leaders Com.Prabhat Kar and Com HL Parvana.

Similarly, as in the past, this time also till the last minute attempts were afoot to create legal hurdles through obtaining some stay order from court, etc. All these ill-motived

efforts could also be frustrated and the Settlement could be signed. It is a unique

achievement indeed.

*One Nation One Salary unique achievement:*

From the earlier period, when salary of the bank employee was differentiated based on the size of the Bank and the place of his working, like A Class Banks, B Class Banks, C Class Banks, and D Class Banks and Area I, II, II and IV based on

population, we achieved uniform Basic Pay/Pay Scales in 1970 in the 2nd Bipartite Settlement but the total emoluments were

based on category of Banks and place of work

of the employee.

Today we are very happy and proud that in

this 11th Bipartite Settlement, we could

achieve ONE NATION ONE SALARY by which employees working in any Bank and in

any place will get the same uniform total emoluments. It is a unique achievement

indeed.

×Achieved under difficult circumstances:*

We cannot forget the fact that our country is

still not out of the challenge and health risk posed by covid19. Because of Covid19, our national economy is facing stagnation and stagflation. GDP has plummeted and

struggling to come up. In no other industry or sector, there are talks of wage revision and wage increase.

In fact, on the other hand,

workers in many sector are facing wage cuts, wage reduction, etc. Even for Government employees, DA has been frozen. It is in this

adverse situation that we have achieved this wage increase. It is a unique achievement indeed.

*Government's policies not so friendly yet we could achieve:*

All of us know the

labour policies of the present Government. It

is not worker-friendly at all. Even minimum wage is being denied to millions of workers.

Labour laws and labour rights are being weakened. Role of trade unions are sought to be diminished. It is significant that in this

scenario, we have been able to conclude the

Settlement successfully. It is a unique achievement indeed.

*Banks passing through tough times, yet we could make it:*

We also know that all

Banks are not doing well. Banks are facing multiple challenges. NPAs are on the increase and revenue level is a matter of concern.

Hence profitability is a major issue for the Banks. Covid19 has added to their problems.

Hence while our demands for more wages are very genuine and quite reasonable, we faced

a lot of problem during negotiations. IBA

started with a meager 2% and it took a lot of efforts including strikes to reach the level of 15% i.e. an amount of Rs. 7,898 crores (Rs.3,385 crores for workmen and Rs. 4,513

crores for officers). This much higher than Rs. 4725 crores that we achieved in the 10th Bipartite Settlement in 2015 (Rs. 2270 crores for workmen and Rs. 2455 crores for officers), an increase of nearly 70% in the total

quantum of hike in the wage revision. It is a

unique achievement indeed.

*Management's various adverse proposals

thwarted:*

When we submitted our Charter of Demands in May, 2017, managements/IBA

submitted various issues as management's issues to be discussed and resolved which included permission to outsource all our regular jobs, introduction of Cost to Company package, Fixed Pay and Variable Pay system, flexibility to transfer employees, premature retirement of employees in public interest, etc. IBA brought all these issues during the

course of negotiations but through our arguments and standpoints, we could thwart all these proposals. It is a unique achievement indeed.

*Improvements in service conditions

secured:*

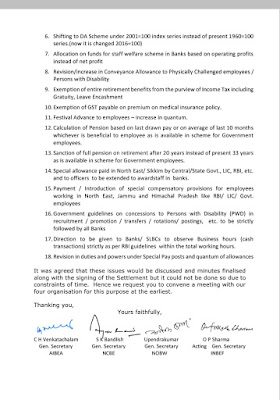

Besides wage increase, various service conditions have been improved upon.

Special Allowance and Transport Allowance

have been improved upon and will attract DA,

Leave benefits like sick leave, maternity leave, paternity leave, special casual leave/curfew leave, special casual leave for

PWD, Leave Fare Concession, Halting

Allowance, Hill and fuel allowance, all other

allowances, etc. have been improved upon.

It is a unique achievement indeed.

*Uniform HRA in all Centres:*

There is a remarkable improvement in HRA. In the 1st BP Settlement, HRA was Rs. 11 to Rs. 25 in

Mumbai and Kolkata. In places with 7 lacs

population & above, it was Rs. 9 to Rs.18. In

other places, no HRA was paid. In the 4th BPS in 1984, even rural area branches were covered for payment of HRA but rates were different for different centres. In this Settlement, for the first time, HRA will be paid at 10.25% to all the employees in all the Centres. Moreover, where an employee is transferred by the management (other than at request), he/she can claim HRA at 1.5% of

his HRA by producing rent receipt. It is a unique achievement indeed.

*New benefits introduced:*

A new Scheme

of Performance Linked Incentive has been

introduced from this year under which all employees will be paid additional incentive amount based on the profit of the Bank.

Similarly, Privilege Leave can be encashed every year for any one of the festivals upto 5/7 days. For the first time, it has been agreed that substaff who pass CAIIB/JAIIB, will be sanctioned additional increments like clerical staff. One more stagnation increment has been introduced and periodicity has been made uniform to all at once in 2 years. All

these are new benefits in this Settlement. It is a unique achievement indeed.

*Retiral benefits will go up:*

In these hardays of unabated inflation and constant fall ivalue of money, while our wages are

important, equally important are our post-

retirement benefits. Under this Settlement, care has been taken to improve retiral benefits also. For the young employees who

have joined Banks after April, 2010, the management's contribution to New Pension Scheme would be 14% instead of present 10% i.e. a 40% increase in the amount of

Bank's contribution to the Fund. For senior

employees, there would be increase iGratuity, Pension, Commutation and Leave

Encashment amounts. It is unique achievement indeed.

*Family Pension being improved:*

It has been recorded in the Settlement itself that

Family Pension would be revised at uniform

rate of 30% without any ceiling. This would

result in increase in the Family Pension of all

existing family pensioners. Ofcourse this would also apply to the families of existing employees who unfortunately die during

service or after retirement. It is a unique

achievement indeed.

*All due to your unity keep it up:*

Dear comrades, all these unique achievements

were possible because of your unity, militancy and faith in the organisation. Ofcourse, achievement is a tradition in AIBEA.

Hearty Greetings to all of you. Massive congratulations to all of you.

We dedicate this Settlement to the hallowed

memory of Com. Prabhat Kar and Com Parvana who are the architects of bipartism in banking industry.

This Settlement is a gift from AIBEA to all our members when we are celebrating the 75th year

Platinum Jubilee of our

beloved AIBEA.

Enjoy the benefits.

Enumerate the achievements to others.

Educate the ignorants.

Eliminate the ill-motived.

Endeavour to strengthen AIBEA - it is yours.

Yours comradely,

C.H. VENKATACHALAM

GENERAL SECRETARY