A blog for sharing of information and for a healthy discussion on Bank employees issues!! *Please send news related to Bank Employees and your Queries, to my e-mail vetrinicchayam@gmail.com* Follow me on facebook http://www.facebook.com/indianbankkumar

Friday, December 31, 2021

Tuesday, November 30, 2021

In the United Forum of Bank Unions' (UFBU) meeting today evening in virtual mode following decisions were taken:

1. 2 day All India Bank Strike will be observed on 16-17 Dec 2021

2. Notice will be served tomorrow

3. Immediately after placement of the Bill for privatisation, Dharna at short notice will be held at New Delhi

4. Preparatory programme will be announced with the circular

5. NOBO and NOBW( both BMS affiliates) will not participate in Dharna and Strike

6. Name of UFBU will be used without mentioning names of the constituents

7. In case the bill is passed before 16th Dec 2021, the UFBU will discuss about lightening strike.

Friday, October 29, 2021

Sunday, September 5, 2021

Wednesday, August 25, 2021

Tuesday, August 17, 2021

Sunday, August 15, 2021

Friday, July 30, 2021

Friday, July 9, 2021

Medical Insurance 2021-22

Health Insurance Policy for Tamilnadu Govt., employees renewed with attractive terms!

Major points:

* Coverage Rs. 5 lacs for 4 years.

* Annual premium Rs.3240+GST per year per employee paid in advance by TN Govt.,

*Recovery of Rs.300 per month from employee

* Employee+Spouse+child under 25 years covered

* 1169 Net work hospitals (for cashless treatment) in Tamilnadu state alone.

* Example: 70 hospitals in Salem dt.itself.

*To provide some hospitals in Bangalore, Trivandrum ,New Delhi also.

* Reimbursement provision for non network hospitals @75% rate

* 203 Diseases (😯) covered

* Pre existing diseases also covered.

*************

My view:

1. Pensioners are not undergoing hospitalisation every year or utilise maximum amount in all years.

Therefore going for a longer period of Health Insurance seems wise.

Premium will be reduced considerably.

In the above case for premium is Rs.12940+GST for 4 years.

2. For Pensioners amount of Insurance may be 10 to 15 lacs for 4 years.

Since spouse only covered other than employee, premium may not on higher side.

3. Maximum hospitals to be brought under cashless treatment to avoid advance expenditure.

Our Associations may keep these points in mind , while going for renewal of policy this year.

It is just a thought for discussion.

Wednesday, April 21, 2021

Wage revision has been completed in Banks and Life Insurance Corporation of India.

I wish to remind you that LIC salary was far below than Banks in 1980s.

Inch by inch they move forward and surpassed Banks and far ahead of Banks today.

I just give an comparison here...

(Any discrepancies will be rectified in due course)

Tuesday, April 13, 2021

Present circular on Family Pension by IBA:

This is applicable for family pension for those who retired after 01.11.2017 as per 11th Bipartite Basic Pay.

It is as per old formula ,i.e.slab system.

Revision of family Pension 30% without ceiling for all family Pensioners (old and new) is still pending with Finance Dept.

After getting approval from Govt. all F.P will be revised according to date of retirement.

Thursday, April 8, 2021

Wednesday, March 24, 2021

Govt. appreciated Bank Employees hard and risky work during Covid 19 time.

( Even today)

We accept your appreciation with pride.

We have done our duty.

But, what Govt. Gives us in return?

Privatisation of Public sector Banks!

What a pity?

*******************

F. no. 16/3/2021-BOA-I

Government of India

Ministry of Finance Department of Financial Services

Jeevan Deep Building, 3rd floor Parliament Street, New Delhi - 110 001

Dated 22nd March 2021

To:

1. Chief Executive, Indian Banks' Association 2. Chairman, State Bank of India

3. Managing Director and Chief Executive Officer

Nationalised banks

Subject: 229th Report of the Department related to Parliamentary Standing Committee on Home Afiairs on Management of Covid-19 pandemic and related issues- regarding

Sir,

Please refer to Department of Financial Services' letter no. 7/3/2021-Parl, dated 16.2.2021, on the above subject.

2

The undersigned is directed to inform that the Parliamentary Standing Committee on Home Affairs on Management of COVID-19 Pandemic and related issues in its 229th Report has observed, inter-alia, as under:

"The Committee notes and appreciates the efforts and pain taken by the banking sector for providing uninterrupted and seamless banking facilities during the COVID-19 outbreak and consequent lockdown. In their sincere efforts to provide continuous service, many of the bank officials also lost their valuable life. The Committee, therefore, places on record the good work done by the banking sector right from the beginning of the COVID-19 Pandemic and observes that they are also recognized as COVID-19 warriors."

3.

Indian Banks' Association may suitably apprise its member banks regarding the above observations and Public Sector Banks may similarly apprise their respective Boards and staff.

Yours faithfully,

Unanatosh Rogl Under Secretary to the Government of India Tel: 011-23748755

Email: boa1-dfs@nic.in

Copy to:

Governor, Reserve Bank of India, Mumbai

Thursday, March 18, 2021

_Dear Comrades,_

_An individual message is under circulation claiming that he is a Bank Employee and that he had got full exemption for his PL encashment i.e., beyond Rs. 3 lakhs from Income Tax Department after two years of correspondence through his auditor._

_We have already clarified that such claims are on misrepresentation of facts and it will attract action from Income Tax Authorities later at any point of time. But still the message is circulated by some people creating unnecessary confusion._

_To clarify the correctness of our stand of the news item, we post herewith the relevant court verdict for reference. Members / Retirees may please be guided accordingly._

_Regards_

*********************

Court verdict on 100% Excemption of tax on Leave encashment at the time of Retirement under section 10(10AA)

********************

Employee of PSU & Nationalised Banks Not Treated as Government Employee for Exemption u/s 10(10AA)

TG Team| Income Tax - Judiciary 25 Aug 2020

Case Law Details

Case Name : Kamal Kumar Kalia & Ors Vs Union Of India & Ors. (Delhi High Court)

Appeal Number : W.P.(C) 11846/2019

Date of Judgement/Order : 08/11/2019

Related Assessment Year :

Courts : All High Courts Delhi High Court

**************************

The issue under consideration is whether the assessee being employee of Public Sector Undertaking (PSU) and Nationalised Banks treated as government employee for the purpose of exemption u/s 10(10AA)(i)?

High Court state that the grievance of the petitioners is that on one hand, the retired employees from the Public Sector Undertaking and Nationalised Banks are discriminated against vis-a-vis the Central Government and State Government employees, on the other hand, the limit for exemption has remained static and has not been enhanced since 1998, even though, multiple Pay Commissions have come into force and have been implemented/adopted since then, even in respect of Public Sector Undertakings and Nationalised Banks.

So far as the challenge to provisions of Section 10 (10AA) of the Act on the ground of discrimination is concerned, we are of the view that there is no merit therein. This is for the reason that employees of the Central Government and State Government form a distinct class and the classification is reasonable having nexus with the object sought to be achieved. The Central Government and State Government employees enjoy a “status” and they are governed by different terms and conditions of the employment. Merely because Public Sector Undertaking and Nationalised Banks are considered as “State” under Article 12 of the Constitution of India for the purpose of entrainment of proceedings under Article 226 of the Constitution and for enforcement of fundamental right under the Constitution, it does not follow that the employees of such Public Sector Undertaking, Nationalised Banks or other institutions which are classified as “State” assume the status of Central Government and State Government employees.

It has been held in multiple decisions that employees of Public Sector Undertakings are not at par with government servants.

HC therefore, reject the present petition, insofar as the petitioners challenge to the provisions of Section 10 (10AA) is concerned.

Thursday, March 11, 2021

Friday, February 26, 2021

Wednesday, February 24, 2021

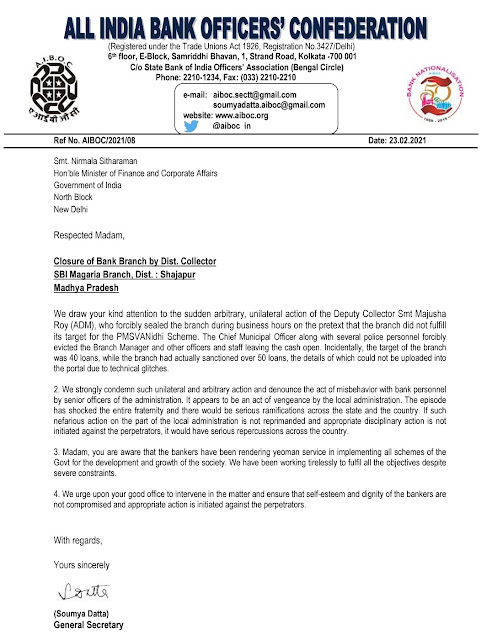

#Suspend_CMO_Shajapur

SBI staff humiliated by #BJPGoons

@nsitharaman @DFS_India This is How You are going to treat us ?

@TheOfficialSBI has been a topper in implementing all Your Schemes, isn't it ?

Is it the Appreciation that we deserve ?

***************

Even after the Directives of @DFS_India and @nsitharaman herself, @collectorshajap ordered CMO, to seal @TheOfficialSBI branch, during which customer and Staffs were manhandled including female staff.

Such outrageous crime shouldn't go unpunished.

#Suspend_CMO_Shajapur

Saturday, February 13, 2021

Thursday, February 11, 2021

Tuesday, February 9, 2021

Saturday, February 6, 2021

Read the following circular on opting / not opting for incremental commutation on revised Pension after 11 th BPS.

One simple question:

Why this option was not given at the time of 7th BPS, 8th BPS, and 9th BPS?

Answer to this question itself will explain the failure of UFBU and weakness in bargaining capacity and the anti employee/ retirees attitude of IBA/Govt.

Lesser percentage increase in Basic and introduction of Spl.Allow. (not taken for Retirement benefits) are the reasons for this situation.

Employees retired after 01.11.2012 will be the losers.

************************

Whether to opt for incremental commutation or not?

My view is..

All employees should opt for incremental commutation.

Don't take risk.

Let signatories of settlement , union officer bearers, committee members, and employees who blindly support unions decision on spl.allow,. forgo incremental commutation and get meagre increased pension.

Sunday, January 31, 2021

A clarification issued by IBA on following provision.

It is applicable to those employees who retired between 01.11.2012 to 30.04.2015 and are eligible for notional benefit of 8th increment before their retirement date.

For your reference ,please read following provision in 10th BPS.

****************

Introduction of 8th stagnation increment mentioned in 10th BPS.

5. Stagnation Increments:

In partial modification of Clause 5 of Bipartite Settlement dated 27th April 2010, both clerical and subordinate staff (including permanent part-time employees on scale wages) shall be eligible for eight stagnation increments w.e.f. 1st November 2012 at the rate and frequency as stated herein under: The clerical and subordinate staff including permanent part-time employees on scale wages on reaching the maximum in their respective scales of pay, shall draw eight stagnation increments at the rate of Rs.1310/- and Rs.655/- (pro rata in respect of permanent part-time employees) each due under this settlement, and at frequencies of 3 years and 2 years respectively, from the dates of reaching the maximum of their scales as aforesaid except that in the case of clerical staff, sixth, seventh and eighth stagnation increments will be released two years after receipt of fifth, sixth and seventh stagnation increments respectively, provided that an employee who has completed two years or more after receiving fifth stagnation increment as on 1st November 2012 shall receive the sixth stagnation increment as on 1st November 2012. Provided further that a clerical / subordinate staff (including permanent part-time employees on scale wages) already in receipt of seven stagnation increments shall be eligible for the eighth stagnation increment on 1st May 2015 or two years after receiving the seventh stagnation increment, whichever is later.

Wednesday, January 27, 2021

Monday, January 25, 2021

Thursday, January 14, 2021

Wednesday, January 13, 2021

Tuesday, January 12, 2021

Friday, January 8, 2021

Monday, January 4, 2021

Friday, January 1, 2021

Jungle law in MUFG (Bank of Tokyo)!

8 permanente employees telephonically terminatted without notice!

Circular: CIR 277 , Protest Email

MUFG Bank is Japanese Bank operating in our country with 3 Branches in Delhi, Chennai and Mumbai. Earlier this Bank was Bank of Tokyo-Mitshibishi and now, after take over, it is called MUFG Bank.

14 permanent employees are working in Bank in the workmen cadre besides officers. All of them have been working in the Bank for past 25 years and more. They are covered by our Bipartite Settlement also. All of them are members of the Union – All India MUFG Bank Employees Association, which is affiliated to AIBEA.

The Bank has been in the process of centralization of its operation in India. Employees have been representing to the Bank to let them know the details of this process to ascertain the impact of the same on their job and job security.

But surprisingly, on the evening of 29th December, 2020, around 4-30 PM, 8 permanent employees of the Bank, 5 in Delhi and 3 in Chennai were telephonically terminated with immediate effect.

This was followed by an email to the employees informing their termination from the Bank’s service with immediate effect from the close of business hours on the 29th December, 2020.

They were also informed that their dues were credited to their account and they are not come to the Bank from the next day i.e. 30th December, 2020.

While the employees were under utter shock, they were virtually evicted from the bank premises and their Access Card, ID Card, etc. were snatched from them by the HR Head. Files and papers belonging to the Union have been confiscated.

In the name of centralization, the Bank has made hundreds of fresh appointments of employees and officers in Mumbai. But these permanent employees have not been given any opportunity or option to relocate to Mumbai and have been forcibly thrown out in the streets all of a sudden in a most cruel and inhuman way.

These are pandemic times and Home Ministry has issued clear guidelines to deal with the workers in private sector including instructions that employees should not be deprived of their wages, etc. But it is so painful and disheartening that this foreign Bank which has come to India to do banking business is flouting all rules, laws and guidelines and have thrown such permanent employees out of job in a most illegal and unfair manner.

Members will recall that this Bank of Tokyo is already a notorious Bank and about 20 years ago, suddenly closed their Kolkata Branch overnight without any notice and which led a prolonged agitation including a call for All India Strike by AIBEA.

Shamefully, once again, the Bank has now resorted to such blatant and flagrant unfair labour practice by terminating the employees on phone. All rules, laws and norms have been thrown to the wind and Bank is terminating permanent employees in this brazen manner just like throwing tissue paper in the dustbin in the washroom.

Obviously this is unfair, cruel and inhuman besides being thoroughly illegal and unlawful. Obviously this cannot be accepted or tolerated. From AIBEA we have already taken up the matter with the Finance Minister and Labour Minister. We have also made the complaint to the Chief Labour Commissioner (Central), Govt. of India.

To express our condemnation and strong protest against the illegal termination of the employees, we call upon all our unions to send the following protest by email to Finance Minister and Labour Minister.

fm@finance.nic.in / nsitharaman@nic.in,

Respected Madam,

We strongly protest against the illegal termination of permanent employees of MUFG Bank – Seek your intervention to instruct the Bank to reinstate them. ……no…………. Name of Union …….

All our units are to send these email under copy to us. Further agitational programmes will be given shortly.

With greetings,

Yours comradely,

C.H. VENKATACHALAM

GENERAL SECRETARY