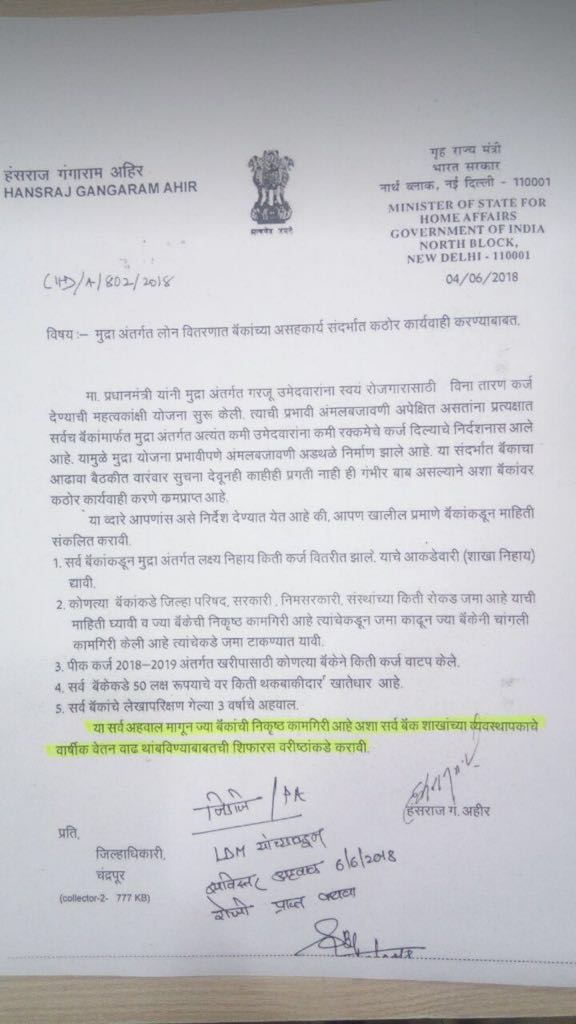

Union Minister of State for Home, Hansraj Ahir has issued a letter to Ashutosh Salil, DM of Chandrapur district in Maharashtra asking him to stop annual salary increment of those branch managers who have not completed their target to sanction the MUDRA loans.

The letter issued on June 6 by MoS for Home Hansraj Ahir orders Ashutosh Salil, to provide data from all banks (branch-wise) regarding the amount of MUDRA loan disbursal against the set target.

Chandrapur DM has also been ordered to collect information about the deposits of Zila Parishad, govt & quasi-govt organisations in banks. Take out deposits from branches that are not performing well and shift the deposits to performing branches.

In a letter, it is also ordered to get the details of 3 years audit reports of all banks, details from banks who have given loans for Kharif crop during 2018-19 and revelation of names of the loan defaulters who have taken more than 50 lacs from the banks.

On May 29, 2018, Prime Minister Narendra Modi said that loans worth Rs. 6 lakh crore were given to 12 crore beneficiaries under the MUDRA scheme and accused the previous governments of tokenism and not doing enough for small businesses.

As per media reports, the government fear that the non-payment of MUDRA loans may further raise the already stashed non-performing assets (NPAs) and may imperil the recovery of banks from the NPA stagnation.

What is Pradhan Mantri MUDRA Yojana (PMMY)?

The Pradhan Mantri MUDRA Yojana (PMMY) was launched by the Prime Minister on April 8, 2015, for providing loans of up to Rs. 10 lakh to the non-corporate, non-farm small/micro enterprises. These loans are classified as MUDRA loans under PMMY. These loans are given by Commercial Banks, RRBs, Small Finance Banks, Cooperative Banks, MFIs and NBFCs.

13 comments:

Hansraj par chadha netagiri Ka bhoot.

Netaji ki *** ki *****.

Ask bank officers to sanction this loan and perform well.and npa recovery 100% .no more compromise in npa recovery for bank officers,they simply doing cross selling.because of more commission is credited to bank officer by doing Cross selling .and high pressure from top officers forcing to do cross selling in branches.

Guarantor bana do uss chutiye ko toh dene mein kya dikkat hai. Guarantor b toh nai banega wo haramkhor.

chodu banadiaa dia hum bankers ko....modi govt ne....sala...kasamse aaur vote nehi dungaa....

Vote kya 20/25 voters ko ready bhi krunga vote na dene ko. Koi bheekh me mili thi ye naukri..?? Sala all india competition tha. Fir bhi bheekhariyo wali haalat bna di.. 10 lakh bank employees.. sb decide kr le 25 logo ko bjp k against vote dilwana hai to 2.5 crore voters hote hain.. anti middle class sarkar aisi hui hi nhi kabhi.. abki baar you go in bhaad..!!

Ea sale log power mai ane k liye kuch bhi kar sakta hai, they are too dangerous, yesterday they abused govt officials, naw bankers, dekhte jao ye log kya kya kar sakta hai, wait n see....., n aur do vote

Ea sale log power mai ane k liye kuch bhi kar sakta hai, they are too dangerous, yesterday they abused govt officials, naw bankers, dekhte jao ye log kya kya kar sakta hai, wait n see....., n aur do vote

Mudra loans (npa) recovery main bitadho isko

Thab patha chelega isko sare details

Yeh log court ka danda kha Kar hi sudhrenge...

Hansraj ke family members Ko loan nahi mila hoga isliye pagla gaya

This is what happens when a dudh wala becomes minister

Tension mat lijiye yeh mudra scheme bahut jaldh expire hone wala hai

Post a Comment